Reply to Income Tax Notice Easily !

₹8,900.00

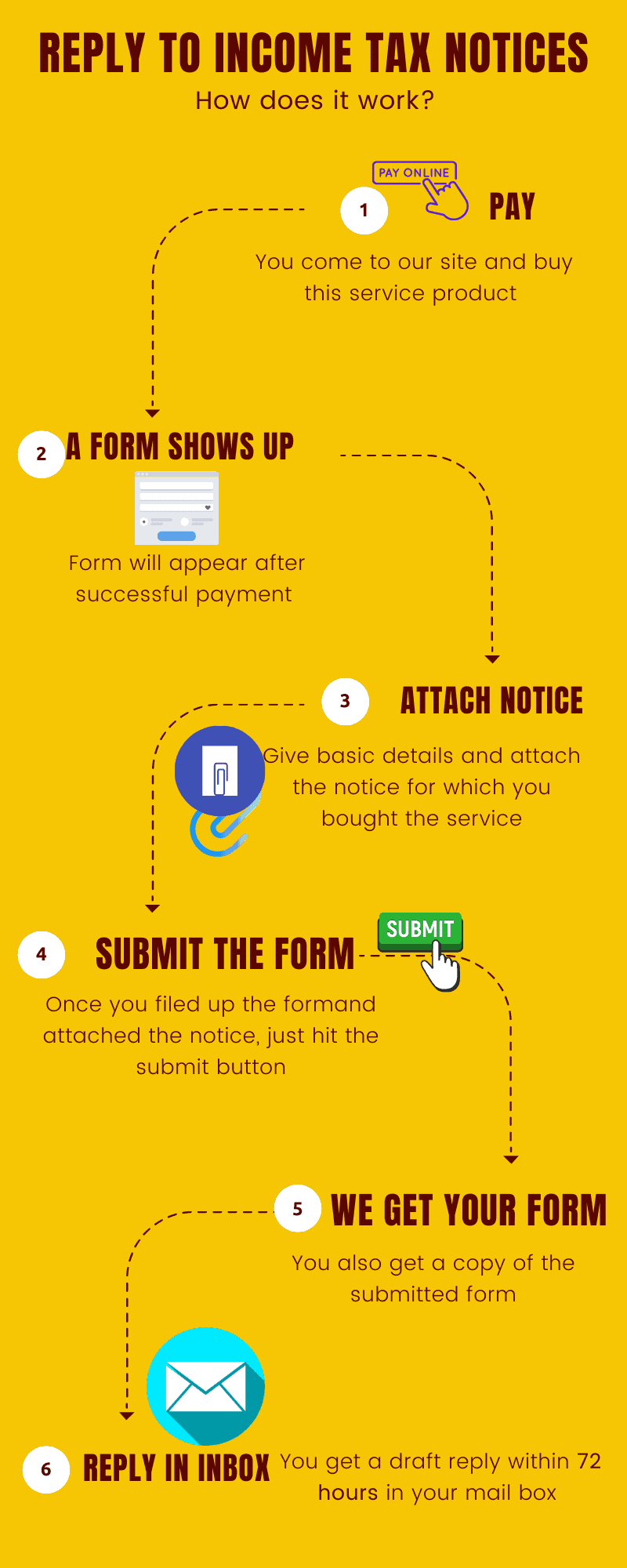

Reply to Income Tax Notice service is designed to provide a quick, legal and factual reply to any kind of notice that you receive from income tax department. Fact is that you can not sit idle and mum when you get income tax notice.The notice may be of various nature -it may be issued for some information u/s 133(6) of the Income Tax Act or section 142(1) read with section 143(2) that indicates that your case is selected for scrutiny and AO desires some answers . There may also be notice u/s 148A that basically show cause why your tax return is reopened for reassessments. Then there are notice for imposing penalty under various section.